In order to let everyone understand the profit and loss of Snowball, the following takes the S&P 500 index as the linked index, with an yield to maturity of 7%, a knock-in point of 93%, a knock-out point of 107%, and a 7-days S&P 500 index Snowball product as an example to analyze several profit and loss situations of Snowball products.

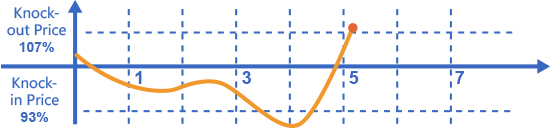

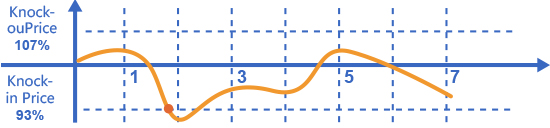

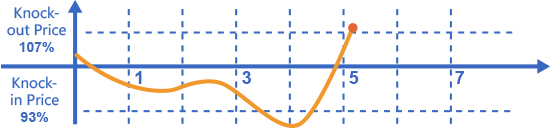

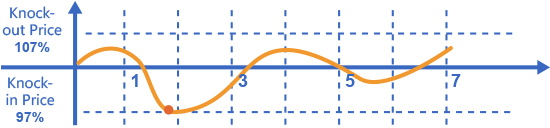

Scenario 1: A knock-out event occurs

Regardless of whether it falls below the knock-in price during the holding period, if on any single holding day, the closing price of the underlying is higher than the knock-out price, the product will be terminated early and the customer will receive the knock-out profit: 7% • (5/7) =5%

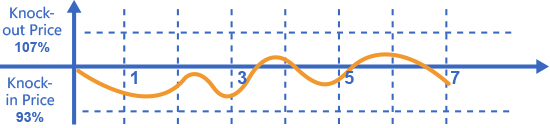

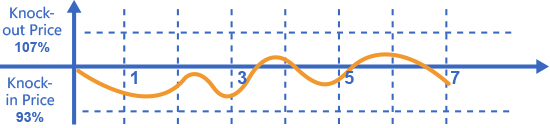

Scenario 2: Neither the knock-in event nor the knock-out event occurs

During the duration, the underlying asset has not fallen to the knock-in price on any single holding day, and has not been knocked out on all holding days; when the product expires, the customer will receive an yield to maturity of 7%.

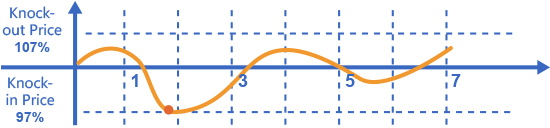

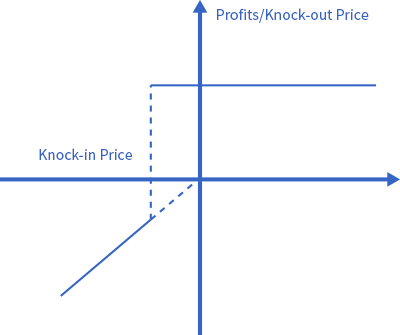

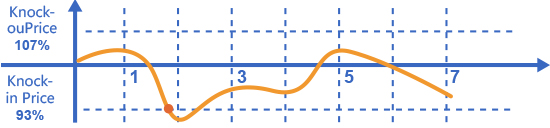

Scenario 3: A knock-in event occurs, but no knock-out event occurs

During the duration, the underlying asset has fallen to the knock-in price on any single holding day, but has not been knocked out on the remaining holding days.

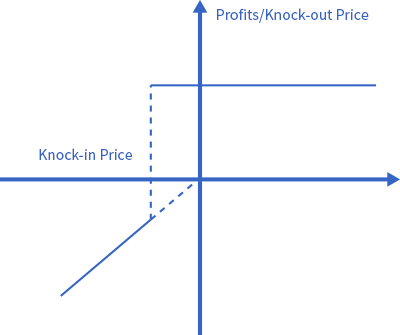

Initial price < Expiration price < knock-out price,Revenue = 0

Underlying expiry price < Initial price, loss =Actual decline of the underlying price at maturity based on the initial price

At present, the Snowball products purchased by individual investors in the market are usually in full margin mode, without leverage and without margin calls. Under the 100% margin mode, when the Snowball product is in operation, no matter how the underlying price fluctuates, investors will not face the risk of "explosion", because the maximum theoretical loss of the Snowball product is the drop of the underlying price to 0, so the theoretical maximum loss is 100% of the margin, and the actual loss is consistent with the drop of the underlying price.